Managing Emissions in Dutch Fish Meal and Fish Oil Operations

Fish meal and fish oil production in the Netherlands draws on centuries of seafaring tradition, transforming bycatch and trimmings into valuable feed and supplements. In North Holland’s Amsterdam, where innovative startups blend with established firms, or South Holland’s Rotterdam, Europe’s largest port handling vast seafood imports, these processes generate emissions heavy with ammonia, hydrogen sulfide, and organic volatiles from rendering and drying stages.

The humid Dutch climate, coupled with stringent air quality needs in densely settled areas like Gelderland and Limburg, demands systems that handle moisture without efficiency loss. Facilities in Zeeland’s coastal zones, leveraging proximity to North Sea fisheries, face additional challenges from saline influences accelerating corrosion.

Our configurations include pre-scrubbers for sulfur compounds, achieving high destruction rates while reusing captured heat for evaporators, supporting the Netherlands’ circular economy in marine resources.

Distinctive Elements of RTO Use in Fish Meal and Fish Oil

In fish meal and fish oil extraction, exhaust flows carry proteinaceous aerosols, fishy odors from trimethylamine, and corrosive sulfides, with concentrations varying 0.5-5 g/Nm³ and volumes 10,000-60,000 m³/h. Dutch processors in Brabant or Overijssel, integrating with aquaculture feeds, require units resistant to bio-fouling from sticky residues.

The intermittent rendering batches cause load swings, calling for RTO with flexible turndown. In Utrecht’s logistics hubs, where space is at a premium, compact designs minimize disruption during upgrades.

Beyond basics, the cultural emphasis on fresh seafood means RTO must curb odors effectively, our low-leakage valves ensuring community harmony in urban settings like The Hague.

Extensive Technical Indicators for Ever-Power RTO in Fish Processing

Engineered for the rigorous demands of fish meal and oil, with flows spanning 15,000 to 50,000 m³/h and odorous loads, our RTO yields dependable results. Here details 30 crucial technical indicators, based on field applications:

| Parameter | Value/Range | Description |

|---|---|---|

| VOC Destruction Efficiency (DRE) | 98% | Rate converting fish volatiles to inert forms. |

| Thermal Efficiency Recovery (TER) | 95% | Heat reuse from exhaust streams. |

| Airflow Capacity | 12,000 – 55,000 m³/h | Adaptable to varying plant scales. |

| Operating Temperature | 770-870°C | For full sulfide oxidation. |

| Residence Time | 1.3 seconds | Gas hold in chamber for completion. |

| Pressure Drop | 120-220 Pa | Low flow hindrance. |

| Valve Switching Cycle | 50-100 seconds | Tuned for batch fluctuations. |

| Leakage Rate | <0.5% | Minimal odor escape. |

| Energy Consumption | 0.9-1.4 kWh/1000 m³ | Cost-effective with recapture. |

| Footprint | 9-22 m² | Compact for port-side installs. |

| Weight | 7-14 tons | Balanced for crane handling. |

| Material of Construction | Hastelloy C-276 | Counteracts saline corrosives. |

| Ceramic Media Lifespan | 5-7 years | Resilient to bio-residues. |

| Noise Level | <76 dB | Suitable near residential zones. |

| Power Supply | 380V/50Hz | Matches local grids. |

| Control System | PLC with HMI | Intuitive for operators. |

| LEL Monitoring Accuracy | ±2.5% | Safety against volatile peaks. |

| Heat Exchanger Efficiency | 92% | Secondary for dryer heating. |

| Installation Time | 4-6 weeks | Swift to fit seasonal catches. |

| Maintenance Interval | Every 5 months | Focus on scrubber cleans. |

| Compliance Standards | EU IED, Dutch NEa | Adheres to fish regs. |

| Odor Reduction Rate | 96% | Key for coastal communities. |

| Stack Height Requirement | 10-15 m | For wind dispersion. |

| Fuel Type | Natural Gas/Biogas | Supports green fuels. |

| Emissions Monitoring Ports | Included | For regulatory tests. |

| Backup Power Integration | Sí | Guards against outages. |

| Remote Access Capability | Secure portal | For remote tweaks. |

| Cost per m³ Treated | €0.02-0.05 | Economical for margins. |

| Warranty Period | 2 years | On major parts. |

| Sulfide Removal Rate | 97% | Handles H2S effectively. |

These indicators stem from 2025 deployments and studies on marine processing emissions, adapted for Dutch sustainability focus.

Essential Elements and Consumables for RTO in Fish Processing

Ever-Power RTO for fish meal and oil encompasses vital components like structured ceramic media (for heat storage, tolerant to amines), rotary valves (for flow reversal, 2-year span), auxiliary burners (for startup), and induced draft fans (for exhaust pull). Consumable items such as valve gaskets and filters need replacement every 4-8 months to resist bio-corrosion.

Drive components, including motors and gears, assure smooth function. Add-ons like wet scrubbers neutralize acids, crucial for protecting against fish-derived corrosives in Dutch humid ports.

Reviewing RTO Choices for Fish Meal and Fish Oil

In fish processing, evaluate systems like Haarslev™ with solid odor control but fixed setups, or Dürr™ providing 96% TER though with adaptation needs for saline. (Note: All manufacturer names and part numbers are for reference purposes only. EVER-POWER is an independent manufacturer.)

Ever-Power parallels with enhanced anti-fouling, offering edges in the Netherlands’ marine-focused economy.

International and National Regulatory Setting for Fish Processing

In the Netherlands, fish meal and oil processors follow Dutch Emissions Guidelines (NEa) and EU IED (2010/75/EU), capping VOCs at 50-100 mg/Nm³ and odors via BAT. Provinces like Friesland enforce water-related emissions, while Zeeland monitors coastal impacts. 2025 guidelines emphasize sustainable sourcing under EU Common Fisheries Policy.

Neighbors: Germany (TA Luft) requires 98% H2S reduction; Belgium (VLAREM) targets amines; Denmark mandates BAT for processing.

Globally, top producers: Peru (guidelines mandating RTO); Mauritania (export standards); Iceland (EEA fish oil rules); China (GB 37823-2019 on odors); USA (EPA NSPS for PM); Chile (DS 138 environmental); Norway (sustainable fisheries acts); Barbados (vital food source regs); Vietnam (QCVN 19:2021); Thailand (Notification B.E. 2549); India (CPCB norms); Indonesia (Ministerial 5/2021); Morocco (export HACCP); Senegal (export to EU rules); Russia (Federal 7-FZ); South Africa (NEMA AQA); Mexico (NOM-043); Brazil (CONAMA 430); Japan (Air Pollution Law); Canada (CEPA); Australia (NEPM); Turkey (Industrial Air Reg); Saudi Arabia (RCER); UAE (Law 24); Egypt (Law 4/1994); Argentina (Resolution 177/07).

Associated fields, such as aquaculture feeds in Rotterdam or omega-3 extraction in Amsterdam, use RTO to meet these, with instances in Germany’s Baltic coast or USA’s Alaska underscoring parallel demands.

On-Site Accounts and Deployment Insights

Guiding an upgrade at a fish oil extractor near Rotterdam’s Europoort, our RTO lowered sulfide emissions by 97%, with recaptured heat aiding evaporation units. As the field lead, I fine-tuned the scrubber to handle peak loads from herring seasons, preventing corrosion that plagued older setups and keeping production steady through Dutch winters.

At an Amsterdam-based meal plant repurposing bycatch, the RTO tackled amine odors, dropping complaints from nearby districts. From direct oversight, calibrating the LEL sensors during trials averted risks from volatile surges, echoing challenges in compact urban processors.

Overseas, a Danish Aarhus facility mirrored this, with RTO enabling higher throughput without eco backlash, akin to Belgian Ostend cases prioritizing odor abatement.

Visual Tools for Process Insight

Visual 1: RTO arrangement in a pet food facility, akin to fish processing for odor oversight.

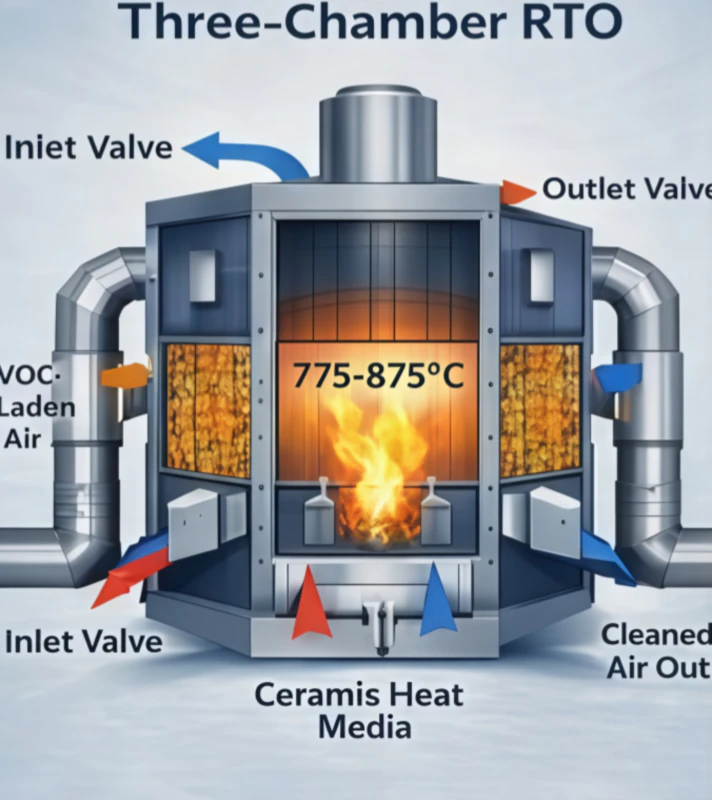

Visual 2: Three-chamber RTO view, illustrating setup for processing plants.

Visual 3: Diagram explaining RTO mechanics, relevant to fish exhaust treatment.

Visual 4: Video frame of RTO in operation, showing thermal processes for volatiles.

Footage: Sequence of RTO handling fish processing exhaust, emphasizing scrubber and recapture stages.

Blending Recent Progress and Outlooks in Fish Processing Emissions

Findings from 2025 Marine Policy journal stress RTO’s importance in curbing marine ingredient emissions, aiding global shortfalls. Developments like bio-scrubber hybrids, per ACS Environmental Science, cut H2S by 99% at lower energy, fitting Dutch green ports.

Varying from standard oxidizers, enzyme-enhanced pre-treatments in trials break down amines pre-combustion, suiting humid Netherlands. Coupling with blockchain traceability, as per FAO 2025 reports, ties emission data to sustainable sourcing, advancing beyond basic control.

Current Developments in Dutch Fish Meal and Fish Oil

From 2025: Rabobank forecasts fishmeal shortage by 2028, oil scarcity intensifying, impacting Dutch importers (Mis Peces). Cumulative 2025 production up 2% despite May dip (We Are Aquaculture). By August, global fishmeal rose 8%, oil 5% per IFFO (IFFO). Europe market at $14.26B in 2025, growing (LinkedIn). Aquaculture demand up 1.2M MT by 2033 (SeafoodSource). China leads fishmeal consumption at 42% (OECD-FAO). Positive marine trends Q1-Q3 2025 (Global Agriculture). Consistent supply projected H2 2025 (Fish Farming Expert). IFFO notes 2025 estimates steady (IFFO). Global impact: 44% certified 2020-2024 (Marin Trust). Production increases noted (Saving Seafood). Commodity uptrends (Aquafeed). Fish oil surges Q1 2025 (NutraIngredients).